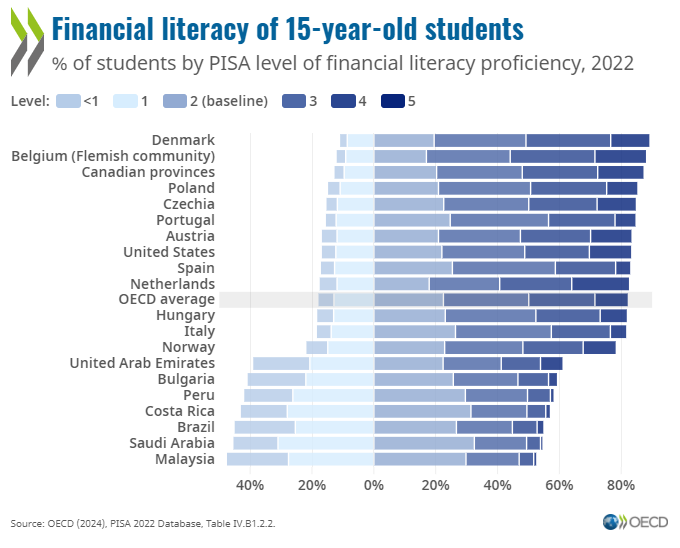

Today, the OECD announced the results of the 2022 Programme for International Student Assessment (PISA) focusing on financial literacy. This comprehensive report examines the understanding of financial matters among 15-year-old students across 20 countries and economies. It not only evaluates their proficiency but also explores the relationship between financial literacy and competencies in mathematics and reading, highlighting significant disparities across socio-demographic groups.

Key Findings: A Global Snapshot of Financial Literacy

- Financial Literacy Proficiency: On average, 18% of students in OECD countries lack basic proficiency in financial literacy. These students struggle to apply their financial knowledge to real-life situations, indicating a critical gap that needs to be addressed to ensure smarter financial decisions as they grow older.

- Income and Literacy Correlation: The report reveals a clear correlation between a country’s income level and financial literacy. Higher income countries tend to have students with better financial literacy. However, significant pockets of financially illiterate youth exist even in the wealthiest nations, especially among students from lower socio-economic backgrounds.

- Global Participation and Performance: The assessment saw participation from a diverse range of countries, including Malaysia (Asia), Brazil, Costa Rica, and Peru (Latin America), and the UAE and Saudi Arabia (MENA). Unfortunately, these countries scored significantly lower compared to their European and US counterparts. Notably, some countries chose not to participate again due to previously low scores.

- Financial Behavior and Literacy Link: There is a strong link between financial literacy and positive financial behavior. High performers in financial literacy are 72% more likely to save money and 50% more likely to compare prices before purchasing. This emphasizes the role of financial literacy in fostering responsible financial behavior among youth.

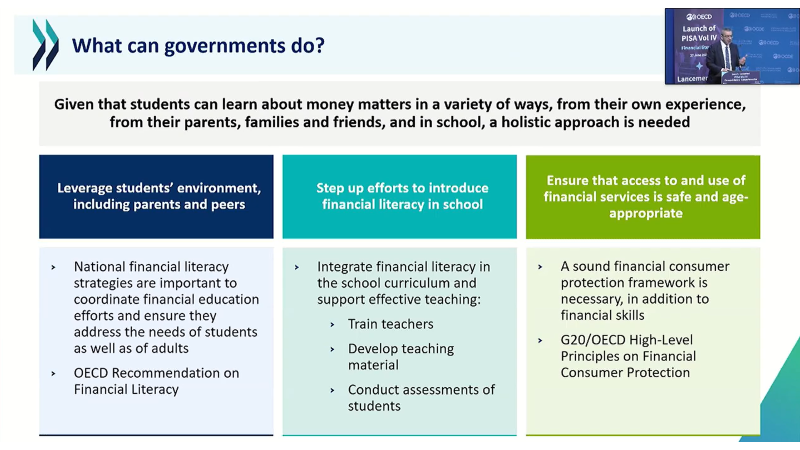

- Role of Parents and Schools: While parents can be a valuable source of financial information, the study found that this alone is insufficient. About 20% of the variation in financial literacy scores is attributed to access to financial literacy lessons in school. Exposure to financial terms and concepts within the school curriculum significantly boosts financial literacy.

- Access to Financial Services: By age 15, many students are already engaging with financial services, particularly through online purchases. This underscores the importance of equipping them with the skills to navigate these services responsibly.

The Need for Dedicated Financial Education

The findings from PISA 2022 highlight a pressing need for dedicated financial education in school curricula. The traditional assumption that quality education in mathematics and general subjects would suffice for financial literacy has been challenged. The presenters strongly recommended integrating financial education using the infusion approach, emphasizing that financial literacy needs focused attention beyond existing educational frameworks.

Empowering the Future

This report is a clear confirmation of the important mission we in Aflatoun have to empower all children and young people, in all regions, especially the most vulnerable with these essential skills. By addressing these gaps, we can ensure that the next generation is better equipped to manage their finances, make informed decisions, and lead financially secure lives.

For a more detailed look at the PISA 2022 Financial Literacy Results visit the PISA 2022 Results (Volume IV): How Financially Smart Are Students? | READ online (oecd-ilibrary.org)

Empowering our youth with financial literacy is not just about improving their future; it’s about shaping a more financially responsible and secure world for all. Only together we can reach this goal! Joint the movement NOW: Our movement – Aflatoun International – Child Social and Financial Education